“This notification

could boost foreign direct investment into the country. The notification of

FEMA (Cross Border Merger) Regulations, 2018, is the last leg of legal

provisions which allows both inbound and outbound mergers of companies in

India. The real beneficiaries of these regulations would be MNCs which in many

cases want to consolidate the business of a region and require mergers

involving an Indian company with other companies in foreign jurisdictions ”

Background

The FEM (Cross Border Merger)

Regulations, 2018 have now been notified vide notification no. FEMA 389/

2018-RB dated 20 March, 2018 and are effective from the date of notification.

As per the Regulations, merger

transactions in compliance with these regulations shall be deemed to have been

approved by RBI, and hence, no separate approval should be required. In other

cases, merger transactions should require prior RBI approval.

Definitions

“Cross Border Merger”

means any merger, amalgamation or arrangement between an Indian company and foreign company, in accordance

with Companies (Compromises, Arrangements and Amalgamation) Rules, 2016

notified under the Companies Act, 2013 (Under the draft regulations, the word

“demerger” was part of the definition of “Cross border merger.” However, the same

has been deleted in the notified regulations).

“Foreign company”

means any company or body corporate incorporated outside India whether having a

place of business in India or not.

“Indian company”

means a company incorporated under the Companies Act, 2013 or under any

previous company law.

“Resultant Company”

means an Indian company or a foreign company, which takes over the assets and

liabilities of the companies involved in the cross border merger.

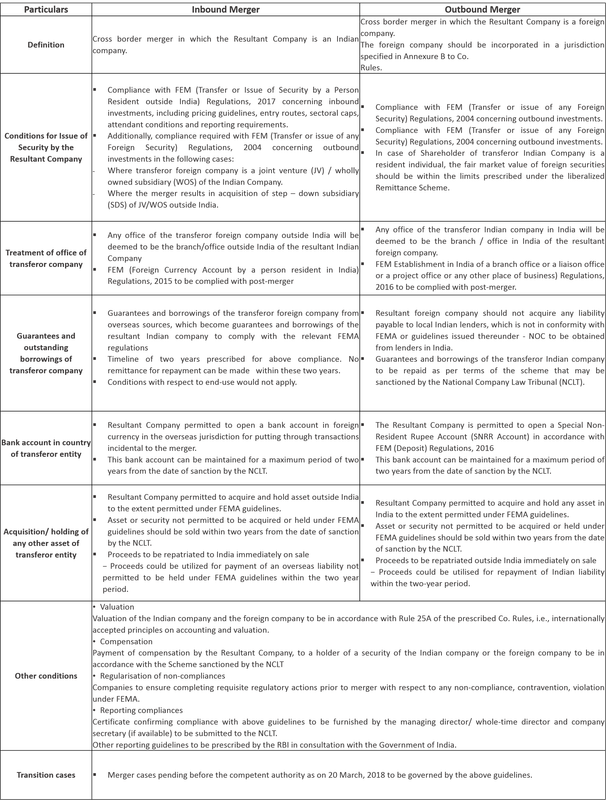

Major Highlights

Conclusion

The notification of FEMA

regulations laying down the framework in relation to cross border mergers is a

positive development, which we believe should facilitate international merger

and acquisition transactions. Given that the guidelines deal with a new set of

transactions, they are likely to evolve based on practical experience, as may

be encountered in the due course of time.

The rules will allow Indian

companies to merge their foreign businesses with their domestic companies while

foreign companies will no longer be required to maintain an Indian company

after a merger and instead fold it up into a single entity. This is expected to

encourage cross-border M&A activity.

The move is likely to have an

impact on insolvency and bankruptcy proceedings as well, since it will

encourage foreign bidders to consider buying Indian assets.

For more detail:

Download

Acquisory News Chronicle - March 2018