Empirically, stock market performance and broad macroeconomic trends have had a strong positive correlation. A couple of notable examples include the market crash of the 1930s following the period of the great depression and the crash of 2008 following the contagion impact of the global financial crisis. In 2020, the onset of the COVID-19 pandemic unleashed a similar sell-off in the global stock markets as countries worldwide initiated complete lockdown programs that further tormented the economy and devasted many livelihoods. The prolonged global lockdown dragged the world economy into recession with many countries experiencing massive GDP contraction.

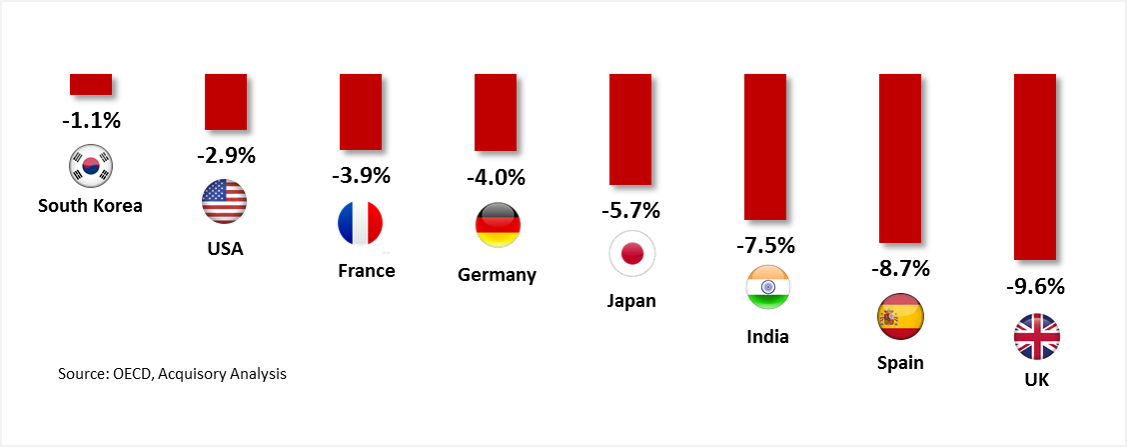

Coronavirus Slump – 2020 Q3 GDP growth in select countries (in %)

With such an economic outlook unfolding, the bear traders would have jumped the gun and extensively shorted the stock market. Much to their surprise, they witnessed a one of its kind bull rally that took the global stock markets to record high levels.

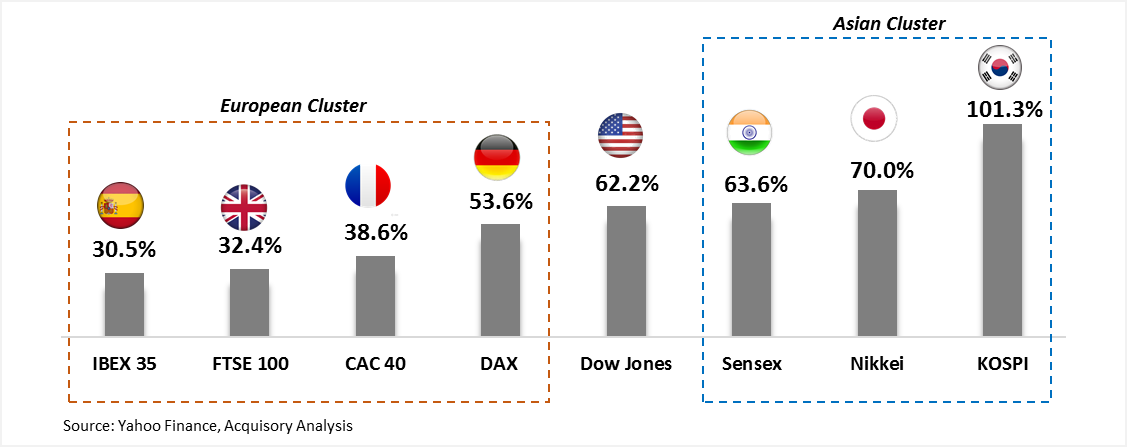

Increase in Global Stock Markets (in %) from Mar’20 to YTD

The global stock markets witnessed an influx of unprecedented buying with most of the global indices achieving record-high levels. Stock markets within the Asian cluster delivered superior performance compared to their European counterparts. Certain indices witnessed 100%+ growth within 9 months. Massive upswings are common in individual scripts, but to see trillion-dollar market capitalization indices deliver such high growth is an addition to the anomalies list of the stock market. It's evident that Macroeconomics doesn’t guide the markets rather its liquidity that sits on the driving seat.

What led to such unprecedented buying?

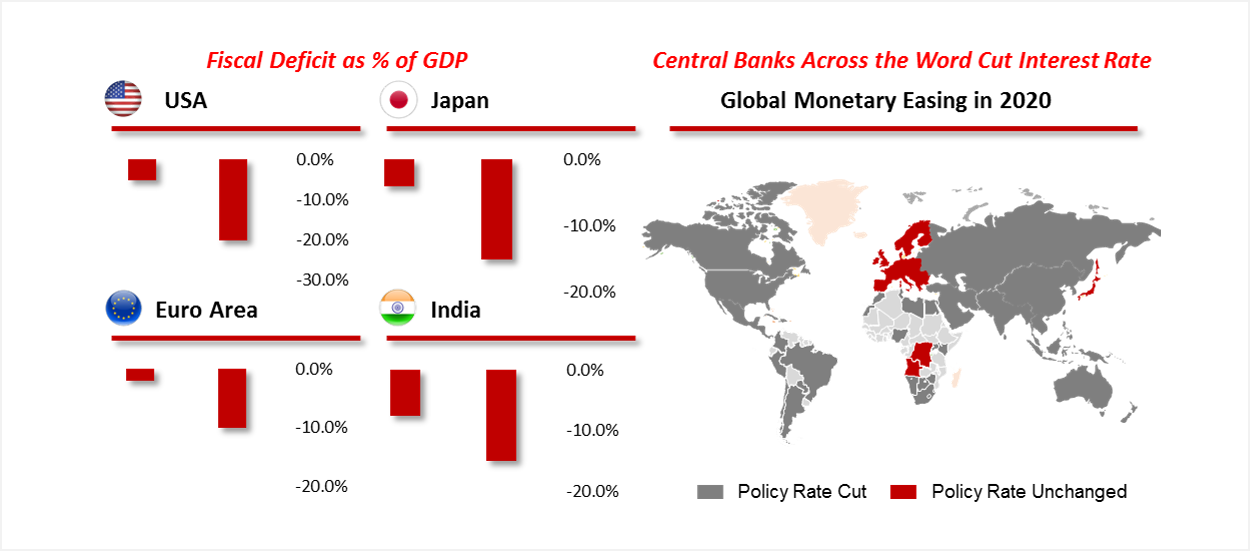

To shield the economy from the trickle-down effect of the pandemic-forced lockdown, global economies announced large-scale stimulus packages and ran budget deficits that add up to ~$11 trillion. These stimulus packages flooded the markets with liquidity as money found its way to enter every economy and every asset class. Apart from the stimulus packages, experts believe that monetary stimulus via interest rate cuts have also led to the surge in the markets. Having learnt from the sub-prime mortgage crisis of 2008, every major central bank announced rate cuts, bought assets directly or indirectly (equities, debt instruments), offered credit lines and bombarded the world with monetary liquidity.

Retail investors cashing in with record high participation

The low-interest rate environment accompanied with enormous liquidity has seen the resurgence of the retail investors with record high participation. In India, over 10 Million retail investors made a stock market debut in 2020, more than double compared to the 4.8 Million debutant in 2019. The age bracket of retail investors between 20-30 has witnessed massive growth for most of the regional brokers in the country. Moreover, in Sep’20 shareholding of retail investors in 1,605 listed Indian companies hit a record 11-year high.

Is the bull run sustainable, or will the market bubble burst?

There’s already a debate about how long governments around the globe can afford to run large fiscal deficits and continue to operate in a low-interest rate environment. On Dec’20, the Price to Earning ratio of NIFTY 50, India’s benchmark stock market index, reached an all-time high of 37.84, up by 87% since 1999. The recent global rally which began with institutional investors pumping money in the system has prompted large scale participation of small retail investors. Carl Icahn and Jeremy Grantham, two of the all-time stock market greats with cumulative investing experience of 120+ years, sense a bubble in the making with public equities being vastly overpriced and due for a steep sell off. In case the markets enter a phase of correction, we will quite certainly experience a situation where many retail investors find it hard to square off their respective holdings without facing the brunt of massive value erosion and a sudden drastic reduction in liquidity.

"You don't get rewarded for taking risk; you get rewarded for buying cheap assets. And if the assets you bought got pushed up in price simply because they were risky, then you are not going to be rewarded for taking a risk; you are going to be punished for it."

Jeremy Grantham, Billionaire investor

Note: Views of the author are personal