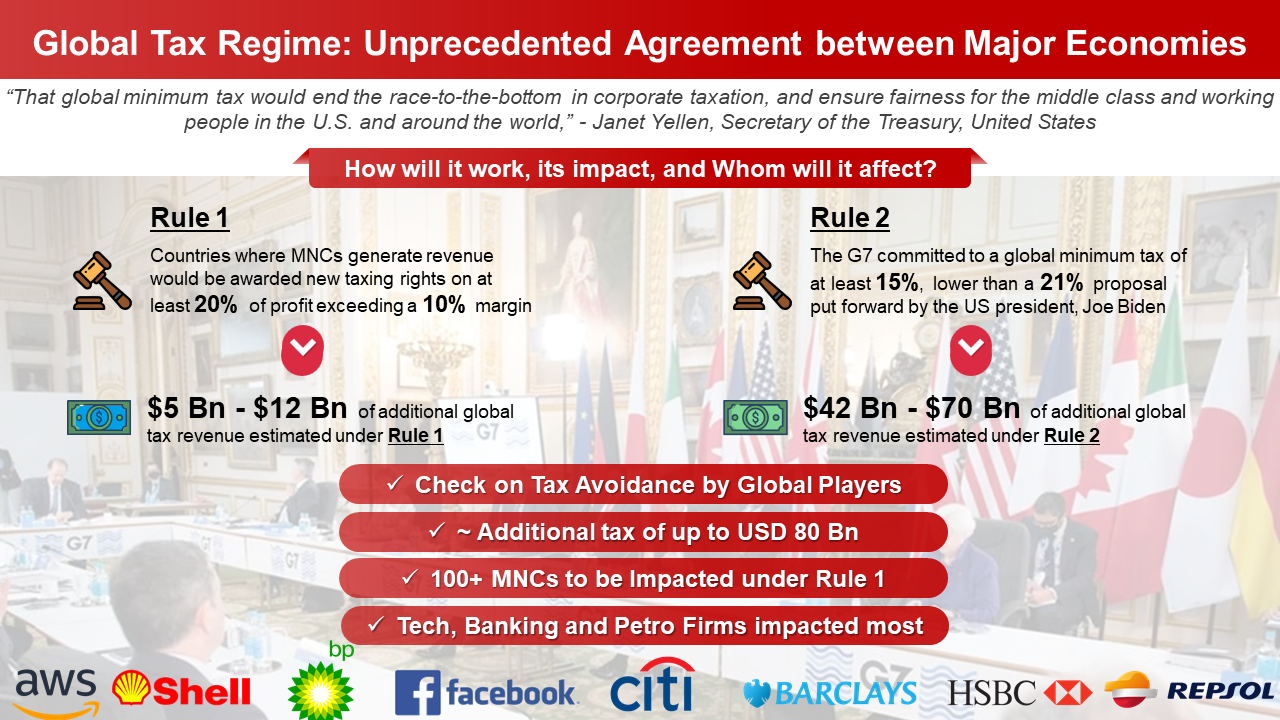

In an unprecedented agreement amongst industrialised nations of G7, an overhaul of global corporate tax regime has been initiated. The major overhaul is directed towards checking tax avoidance and jurisdictional arbitrage exploited by the world’s largest entities. Major economies are aiming to discourage multinationals from shifting profits — and tax revenues — to low tax countries regardless of where their sales are made. While many more rounds of discussions are expected before a final shape to this is given, we believe that this move is transformational and hopefully lead to a fair and more equitable tax regime across the globe.

For more details please go to Download