India does not have a regulated cryptocurrency market. The draft Cryptocurrency & Regulation of Official Digital Currency Bill, 2021 (‘Cryptocurrency Bill 2021’), which is yet to be passed by the cabinet, aims to ban all private crypto currencies except those issued by the state. So, no person shall mine, generate, hold, deal, issue, transfer or use of crypto currencies in the territory of India. However, the RBI has not proposed to ban underlying block-chain platforms.

Regulatory framework for Crypto currency in India

With many different forms of cryptocurrencies trading in India, the government sought to regulate the market as there was no law / act which governed cryptocurrencies. Reserve Bank of India (RBI) issued several notifications and circulars in 2013, 2017 and 2018 to safeguard the customers from its perception of potential threats from crypto. It was believed that crypto assets might lead to possible money laundering, fraud, and terror financing.

RBI’s 2018 circular led to a prohibition of the crypto industry in India which adversely impacted the homegrown crypto exchanges. Subsequently, in March 2020, the Supreme Court judgement was supportive of crypto assets and paved the way for lifting prior restrictions. The government then proposed the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, which intended to facilitate India’s own official digital currency issued by the RBI and allowing experimentation with other crypto assets.

The Ministry of Corporate Affairs (MCA) had also announced amendments to Schedule III of the Companies Act, 2013 in March 2021, which now mandates companies dealing with digital currencies to disclose profit or loss incurred on crypto transactions, the number of crypto assets held, and deposits held.

Major highlights of Cryptocurrency Bill 2021

The key purpose of the bill will be the “creation of the official digital currency to be issued by the Reserve Bank of India”.

The main purpose of the Cryptocurrency Bill, 2021

- To create an enabling framework for the creation of the official digital currency to be issued by the Reserve Bank of India.

- To prohibit all private cryptocurrencies in India

- Allow for certain exceptions to promote the underlying technology of cryptocurrency and its uses.

- Further, the cryptocurrencies other than issued by the Central Government shall not be used as legal tender within India.

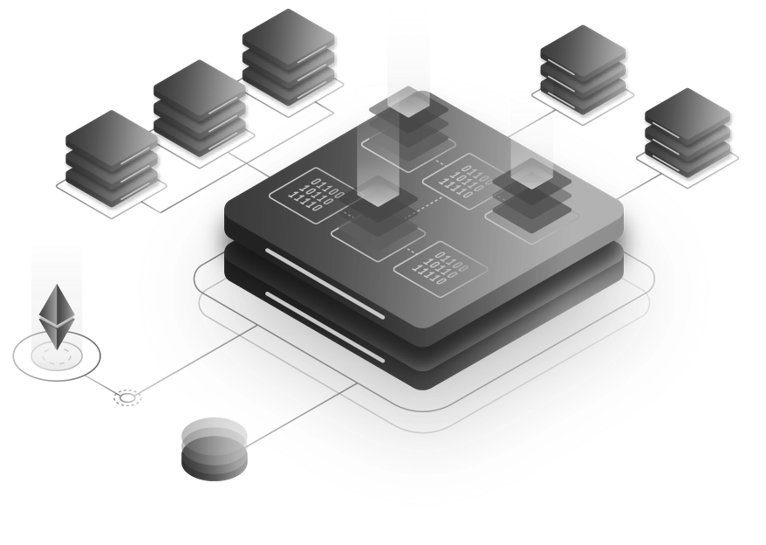

Government can put a ban on Ether but the Ethereum blockchain, which facilitates smart contracts doesn’t come under the ambit of the ban. So, the same can be used for the purpose of research or experiment.

Indians till May 2021 have invested around $ 6.6 billion in cryptocurrencies, as per an Analytics Insight report (Soure: https://bit.ly/3gPfdlH). The same saw an over 600 per cent jump from $923 million in April 2020. It is seen that nearly 1.5 crore Indians are said to have invested in cryptocurrencies. Presently, over 350 start-ups operate in the blockchain and cryptocurrency space. Taking into consideration the huge interest from the investors and with rapidly growing cryptocurrency market, the government is taking cautious approach towards cryptocurrencies.

Conclusion

Cryptocurrencies are becoming an ever-increasing phenomenon across the globe. The Indian government has been sitting on the fence for a long time over cryptocurrencies in the country. Currently, cryptocurrencies are under no regulation in India, which makes it a grey area for Indian investors. Once the Cryptocurrency Bill, 2021 is regularised, then accordingly the other regulatory authorities shall also issue guidance on various aspects of Cryptocurrency. The market for such will be transparent and clean to operate for the investors. After the SC lifted the ban, multiple new start-ups based on blockchain and many more Indian Intermediary platforms had begun operations. However, with RBI introducing its own cryptocurrency it is possible banks and financial institution involve themselves in cryptocurrency directly, eliminating intermediaries. In addition, with the significant volume of crypto assets in India, the taxation aspect must be taken into consideration. Overall, the regulations are expected to make a disruptive mechanism transparent and accessible.